In the 1820s and 1830s, state governments made large investments in canals, railroads, and banks. New York and Ohio were the first two states to start canal projects. At first, the expected revenue from the projects was low or uncertain, so New York and Ohio raised taxes to service the canal debt. But the Erie and Ohio canals were highly successful, so subsequent canal construction was financed without corresponding tax increases. New York, Ohio, and other states expected internal improvement projects to produce future revenue, so they didn't feel the need to raise taxes when they began new projects. States were easily able to issue bonds to domestic and foreign (especially British) investors to finance their projects:

“Both state borrowers and lenders, foreign and domestic, anticipated that states could tax land if their bank and transportation projects failed. After 1836, increasing land values and taxable acreage were the common factor underlying state fiscal policies, bank investments, and transportation improvements nationwide. Northeastern states knew they had large amounts of untaxed land, rising in value. It was a fiscal reserve against which they could borrow to finance extensions of their transportation systems. Western states, north and south, were in the midst of the greatest land boom in American history. If northwestern states were uncertain about just when transportation investments would generate revenues, they nonetheless anticipated that many more, and more valuable, acres could soon be taxed. States were thus confident that property tax proceeds would provide adequate fiscal resources to service the debts they incurred. Investors in state bonds concurred.”State government bonds were considered safe assets because it seemed inconceivable that a state government could default-- their investments were expected to be profitable, and even if they weren't, the states had plenty of potential to increase their tax revenue, especially since land value was rising. Grinath et al. quote Illinois Governor Ford as saying "Mere possibilities appeared to be highly probable, and probabilities wore the livery of certainty itself.”

Gary Gorton, Stefan Lewellen, and Andrew Metrick define a safe asset as one that is information-insensitive. "To the extent that debt is information-insensitive, it can be used efficiently as collateral in financial transactions, a role in finance that is analogous to the role of money in commerce." Gorton elaborates on this idea in an interview with the Region magazine, explaining that debt is "easiest to trade if you’re sure that neither party knows anything about the payoff on the debt." In other words, "The depositors believe that the collateral has the feature that nobody has any private information about it. We can all just believe that it’s all AAA."

In the 1830s, both the states and the investors in state bonds could "believe that it's all AAA" since, even if investment projects turned out not to generate much revenue, states had seemingly boundless untapped tax potential. Thus it was unnecessary for investors in state bonds to find information about the details of states' particular projects. State debt was information-insensitive, a useful property considering how slowly information traveled across the Atlantic in those days. No need to calculate probabilities when probabilities wear the "livery of certainty itself."

Gorton says that the few really big crisis events in history come from a regime switch in which debt that is information-insensitive becomes information-sensitive. This is precisely what happened in the U.S. states. During the early 1830s expansion and boom of 1835, state debt was information-insensitive, especially as ever-rising land prices promised a large and growing fiscal reserve. But as several domestic and external factors combined to bring about the panic of 1837 and collapse of 1839, the strength of the fiscal reserve was challenged. As land values and property taxes fell, the quality of state's canal, bank, and railroad investment projects suddenly mattered for their ability to service their debt. The situation is described in another paper by Wallis and Namsuk Kim:

In July of 1839, the Morris Canal and Banking Company of New Jersey defaulted on Indiana, and the state quickly was forced to curtail construction on its network of canals and railroads. By the autumn, Illinois and Michigan were forced to slow or stop construction when investment banks defaulted on their obligations to the states. Land sales and land values in these northwestern states had been rising steadily through the 1830s. When transportation construction stopped, land values and property tax revenues began falling and, by late 1839, it was apparent that these states would soon have trouble servicing their debts. In January

of 1841, Indiana was the first state to default on interest payments.

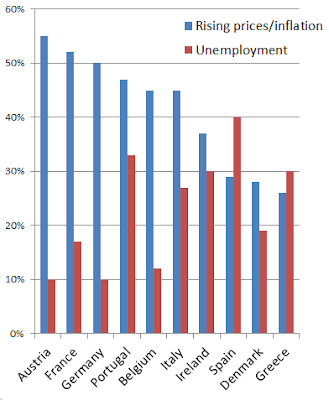

It was a nasty spiral-- as infrastructure projects failed, land values and tax revenue fell further, eroding the states' fiscal positions, making it harder for them to issue bonds and forcing them to pay higher interest rates. This further deteriorated their fiscal positions, and led to suspensions of infrastructure projects and yet higher interest rates. This is similar to what happened in the eurozone, for example in Greece. In the early 2000s, Greece was able to run large deficits without facing high borrowing costs, because the growing economy made Greek sovereign debt information-insensitive. The economic crisis was a "regime change" making sovereign debt information-sensitive. Without the benefit of a fast-growing economy, the Greek government's ability to pay depending much more on its fiscal position, so borrowing rates rose, causing an even worse fiscal position.

The parallels with Greece continue. Many states found, when they tried to raise taxes, that they lacked the state capacity to do so. Property taxes were extremely politically unpopular, and states had trouble not only passing tax legislation but also implementing tax collection. In Maryland, for example, three counties refused to remit their share of the property tax imposed in 1841, and seven refused in 1842. It wasn't until 1845 that the tax was effectively implemented, allowing Maryland to resume debt service. Other states were even less successful in raising property taxes and ended up defaulting and repudiating their debt. Greece also faces a tax evasion problem and encountered serious public and political opposition to attempted austerity measures. In an earlier post I mentioned a paper by Mark Dincecco and Gabriel Katz called "State Capacity and Long Run Performance." State capacity refers a state's ability to tax and to provide public goods and services, called its extractive and productive capabilities, respectively. Dincecco and Katz write:

We argue that the implementation of uniform tax systems at the national level – which we call “fiscal centralization”– enabled European states to effectively fulfill their extractive role. This transformation typically occurred swiftly and permanently from 1789 onward. Similarly, we argue that the establishment of parliaments that could monitor public expenditures at regular intervals – called “limited government” – enabled them to effectively fulfill their productive role. This transformation typically occurred decades after fiscal centralization over the nineteenth century. By the mid-1800s, most European states had achieved “modern” extractive and productive capabilities, implying that they could gather large tax revenues and effectively channel funds toward non-military public services. We argue that these critical improvements in state capacity had strongly positive performance impacts.

The institutional changes that Dincecco and Katz describe in the late 18th century Europe that brought about extractive capabilities include fiscal centralization and parliamentary, limited government. The U.S. states in the 1840s, and apparently some of the European states today, lack such state capacity, a fact which plays a role in the crises then and now.

Pennsylvania's canals were a financial disaster, so the state faced particularly high borrowing costs, until the Bank of the United States was rechartered as the Bank of the United States Pennsylvania (BUSP). The bank's charter included a promise to underwrite $6 to 8 million in state bond issues. The bank agreed to lend to Pennsylvania at 4%, and as a result, Pennsylvania bond yields in Philadelphia stayed very near to 4% for the next few years. Wallis and Kim write, "Deliberately or not, the BUSP pegged the price of Pennsylvania bonds as a result of its obligations to purchase state bonds over this 18-month period." This is similar to the ECB's Outright Monetary Transactions (OMT) policy, which, by promising to buy sovereign bonds of Eurozone member states, aims to bring down bond yields and lower borrowing costs for countries that face problems selling debt. Though the bank loan program in Pennsylvania was temporarily successful in helping Pennsylvania borrow at lower cost, when the BUSP closed down in 1841, Pennsylvania bond yields jumped immediately, from 6.01% in January 1841 to 9.5% in March.

What ultimately happened in the United States was that the debt crisis forced a change in the structure of public finance. States initiated constitutional restrictions on debt issue and instituted requirements that new spending be matched by new tax increases. The debt crisis in the euro area is also likely to change the structure of public finance, but not in the same way. The United States is both a monetary union and a fiscal union, so even though the states adopted balanced budget amendments, the federal government could still do countercyclical fiscal policy. The euro area is a monetary union without a fiscal union, so it would be very costly for states to institute such restrictions on deficit spending. One possibility is that the euro area will become more of a fiscal and/or banking union; or there may be other changes in the structure of public finance that I can't foresee.

Pennsylvania's canals were a financial disaster, so the state faced particularly high borrowing costs, until the Bank of the United States was rechartered as the Bank of the United States Pennsylvania (BUSP). The bank's charter included a promise to underwrite $6 to 8 million in state bond issues. The bank agreed to lend to Pennsylvania at 4%, and as a result, Pennsylvania bond yields in Philadelphia stayed very near to 4% for the next few years. Wallis and Kim write, "Deliberately or not, the BUSP pegged the price of Pennsylvania bonds as a result of its obligations to purchase state bonds over this 18-month period." This is similar to the ECB's Outright Monetary Transactions (OMT) policy, which, by promising to buy sovereign bonds of Eurozone member states, aims to bring down bond yields and lower borrowing costs for countries that face problems selling debt. Though the bank loan program in Pennsylvania was temporarily successful in helping Pennsylvania borrow at lower cost, when the BUSP closed down in 1841, Pennsylvania bond yields jumped immediately, from 6.01% in January 1841 to 9.5% in March.

What ultimately happened in the United States was that the debt crisis forced a change in the structure of public finance. States initiated constitutional restrictions on debt issue and instituted requirements that new spending be matched by new tax increases. The debt crisis in the euro area is also likely to change the structure of public finance, but not in the same way. The United States is both a monetary union and a fiscal union, so even though the states adopted balanced budget amendments, the federal government could still do countercyclical fiscal policy. The euro area is a monetary union without a fiscal union, so it would be very costly for states to institute such restrictions on deficit spending. One possibility is that the euro area will become more of a fiscal and/or banking union; or there may be other changes in the structure of public finance that I can't foresee.