Since the 1980s U.S. households have dramatically increased

the amount of debt they hold. One frequent explanation for this trend is that

the large increase in income inequality over this same period caused households

to borrow more (see Figure 1). The intuition is that low-income households

attempted to “keep up” with the increasing consumption of their high-income

neighbors. This could affect debt levels if the low-income household decides to

fund its consumption by leveraging with debt (as opposed to increasing labor

supply or drawing down assets). This type of behavior is often referred to as

“keeping up with the Joneses”, consumption cascades, consumption spillovers, or

external habit.

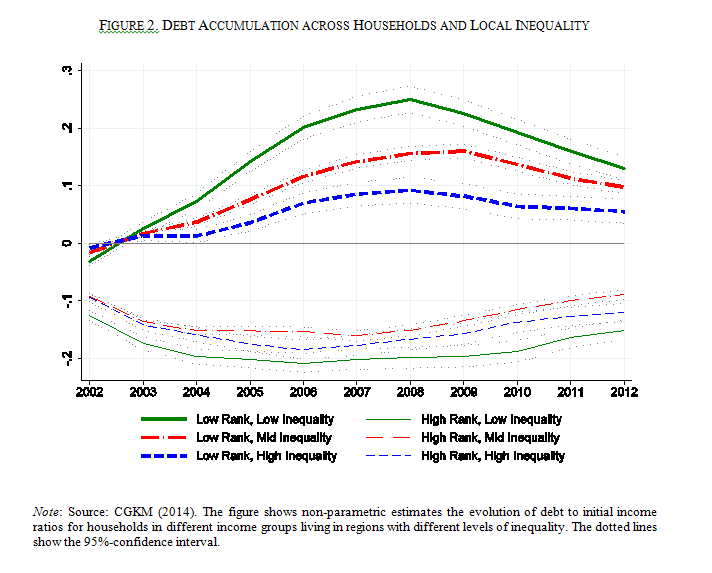

In a working paper I have with Olivier Coibion, Yuriy

Gorodnichenko, and Marianna Kudlyak we look at whether, in the years running up

to the financial crisis as well as during the Great Recession, low-, middle-,

and high-income households accumulated different amounts of debt (relative to

their incomes) depending on the level of

income inequality in their region. Our main finding is that low-income households

in high-inequality areas increased their leverage by less than similar

households in low-inequality areas. Our non-parametric results in Figure 2

suggest that a household in the bottom third of the income distribution within

their area and inequality distribution across areas increased their leverage by

around 15 percentage points more than a similar household in the top third of

the inequality distribution in the years immediately prior to the financial

crisis. This is the exact opposite effect one would expect if “keeping up with

the Joneses” was the primary cause of borrowing by low-income households.

Because our data (see Additional Details below) allow us to

break debt into pieces, we can examine which types of debt are driving these

differences. While we find similar patterns for mortgage debt, auto debt, and

credit card limits as those documented for total debt accumulation, we find no

systematic differences across households and inequality regions in terms of

their credit card balances. Since credit card limits primarily reflect credit

supply conditions whereas credit card balances reflect households’ demand for

credit, we interpret the difference in results across credit card limits and

balances as pointing toward credit supply factors as the root cause of the link

between inequality and borrowing.

The intuition is simple. First, lenders confront asymmetric

information as they try to infer which borrowers are less likely to default.

Second, high-income borrowers are less likely to default so lenders use income

as a way to infer borrower type. In a perfectly equal income distribution all

borrowers are equally likely to be a high or low default risk. But as

inequality increases and the income difference between low- and high-income

borrowers becomes larger, high-risk and low-risk borrowers are easier to tell

apart when they reveal their incomes to banks. Lenders will then be able to

offer cheaper and more readily accessible credit to high-income/low-risk

borrowers as well as more likely to deny loans to low-income/high-risk

borrowers. To test these predictions we use data from the Home Mortgage

Disclosure Act (HMDA) which requires mortgage lenders to report details on

applications including whether a loan was denied, the size of the loan, income

of the applicant, and other characteristics. We find that low-income applicants

are more likely to be denied mortgages and to be charged a high interest rate

in high-inequality areas relative to similar applicants in low-inequality

areas. Thus, this evidence also supports a credit supply interpretation of the

link between local income inequality and differential borrowing patterns across

income groups that is at odds with the “keeping up with the Joneses”

interpretation.

Part of the reason I was invited to write here was to

discuss the differences between our results and those in a recent paper by

Bertrand and Morse, because their empirical findings do provide evidence

of “keeping up with the Joneses” forces. There are at least two important

differences. First, their outcome is consumption while ours is debt. It is

possible that low-income households funded their consumption with changes in

labor supply, savings, or even some debt. But our results tell us that any use

of debt in this way cannot be the primary story of inequality and debt

accumulation during this period. This is important to note because debt

accumulation was central to the creation of many of the financial assets behind

the financial crisis. Second, Bertrand and Morse use changes in consumption

among the wealthy as their explanatory variable while we use inequality. It is

possible that in some areas the consumption differences between households are

not as large as in other areas even though both have the same measured

inequality. This can occur if there is variation in precautionary savings, the

“visibility” of consumption bundles, or the proximity of high- and low-income

households. As the relationship between high-income household consumption and

measured inequality becomes more complex our results become less directly

comparable.

Thanks very much to Carola for having us!

Additional Details

The data we use for our primary results are from the New York Federal Reserve Bank Consumer Credit Panel/Equifax (referred to as the CCP), which provides comprehensive debt measures for millions of U.S. households since 1999. Because these data do not include income we impute incomes using the relationship between common observables in the Survey of Consumer Finances. Using these imputed incomes we construct measures of local inequality, household positions in the income distribution, and household debt-to-income ratios. We are able to check our measures of inequality and rank against various external measures and find they are very highly correlated.

Our results are robust to the level at which we measure inequality (zip, county, state), the measure of inequality we use (ratio of log incomes at the 90th and 10th percentile from the CCP, Gini coefficients from the IRS and Census data), an extensive set of household and area controls, and numerous splits of our sample. In particular our results hold within subsamples defined according to house price appreciation, average credit scores, income levels, initial debt ratios, and geographic regions.

This comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteMany thanks for the amazing essay I really gained a lot of info. That I was searching for

ReplyDelete

ReplyDeleteMany thanks for the amazing essay I really gained a lot of info. That I was searching for

ReplyDeleteMany thanks for the amazing essay I really gained a lot of info. That I was searching for