"How do aggregate wealth-to-income ratios evolve in the long run and why? We address this question using 1970-2010 national balance sheets recently compiled in the top eight developed economies. For the U.S., U.K., Germany, and France, we are able to extend our analysis as far back as 1700. We find in every country a gradual rise of wealth-income ratios in recent decades, from about 200-300% in 1970 to 400-600% in 2010. In effect, today’s ratios appear to be returning to the high values observed in Europe in the eighteenth and nineteenth centuries (600-700%). This can be explained by a long run asset price recovery (itself driven by changes in capital policies since the world wars) and by the slowdown of productivity and population growth...Our results have important implications for capital taxation and regulation and shed new light on the changing nature of wealth, the shape of the production function, and the rise of capital shares."The authors put together a new macro-historical data set on wealth and income, available online, which is "the first international database to include long-run, homogeneous information on national wealth...It can be used to study core macroeconomic questions – such as private capital accumulation, the dynamics of the public debt, and patterns in net foreign asset positions – altogether and over unusually long periods of time."

They suggest that from the interwar period until the 1870s, asset prices were depressed. Then an asset price recovery was driven by changes in capital policies. A U-shaped history of wealth-income ratios is more pronounced for Europe than for the US (Figure 4).

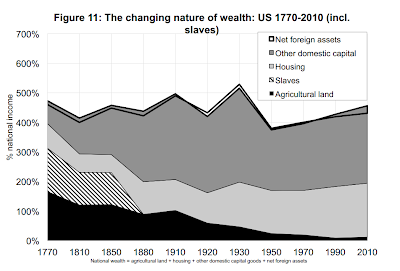

The following two figures show the changing nature of national wealth in the UK (Figure 3) and the US (Figure 10). (The picture for France is quite similar to the UK.) Agricultural land accounted for a staggering 400% of national income in 1870 in the UK, and is basically negligible now. The picture for the US changes if you include slaves as wealth in the antebellum period (Figure 11).

The author also decompose the accumulation of national wealth from 1970-2010 into a saving-induced wealth growth rate and a capital-gains-induced wealth growth rate for eight rich countries (Table 4). Germany is the only country to have experienced a negative capital-gains-induced wealth growth rate.

In Figure 16, below, Piketty and Zucman make a variety of assumptions to compute and simulate the worldwide private wealth to national income ratio from 1870-2100. The ratio bottomed-out in 1950, and they predict that it will continue to rise. This means, they suggest, that wealth inequality is likely to matter more now than in the postwar period, and will continue to matter even more in the future, raising a new set of issues about capital regulation and taxation.

Piketty's new book, Le Capital au XXIe siècle, was published in Paris on Friday. Amazon.fr sent it to me the same day (I live in France), but I am only a tenth of the way into it's 970 pages, since I read French more slowly than English. The book is based on this research, from which he sees strong evidence that in the present world capitalist system economic inequality is bound to increase (quelle surprise). I understand he argues for a wealth tax towards the end.

ReplyDeleteThe book is easy to read, and I hope it will be translated into English.

Thanks for letting me know, Farrar. I don't read French but will wait and see if it comes out in English.

ReplyDeleteI really impressed after read this because of some quality work and informative thoughts . I just wanna say thanks for the writer and wish you all the best for coming!. recover money lost to binary options

ReplyDeleteEMERGENCY LOAN OFFER APPLY

ReplyDeleteWe Offer all types of Finance Business Personal Cash

Quick Cash Advance. Fast Credit Check. Cash Today.

Fast Cash Online

low interest rate as low as 2%

Financial Cash Available Here

Business Personal Cash

Solve Your Financial Problems

I'll advise All Cash seeker should contact us

THERE IS NOTHING TO LOSE BUT YOUR DEBT AND FINANCIAL PROBLEMS !!!

We Are Here To Show You A Better Way To Financial Freedom !!!

Contact Us At : abdullahibrahimlender@gmail.com

whatspp Number +918929490461

Mr Abdullah Ibrahim