The European Commission's Eurobarometer survey monitors public opinion on a variety of political and economic issues across European Union member states. One question on the Eurobarometer survey asks:

Personally, what are the two most important issues you are facing at the moment?

This question was only asked in May 2012. For the EU as a whole, by far the most common response was rising prices/inflation. In fact, 45% of people in 2012 said that inflation was one of the top two most important issues they were facing. The pie graph below shows, for the EU as a whole, the responses people chose. Only 15% of people chose the financial situation of their household as a top issue. Health and social security also had a mere 15%. I was stunned that three times as many people consider inflation a top issue as consider health and social security a top issue.

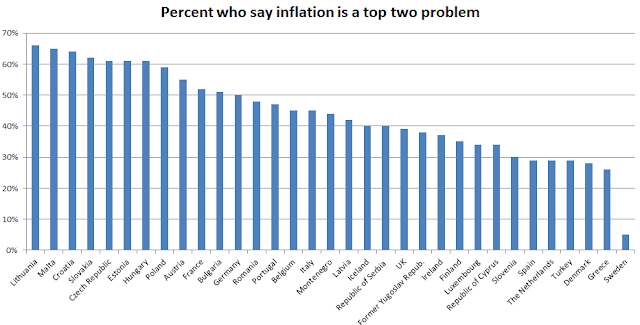

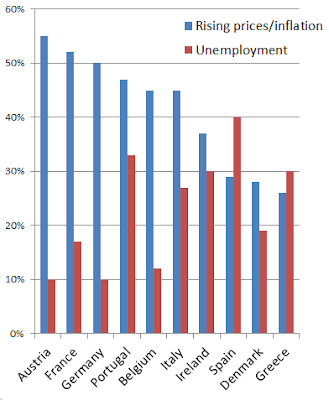

In the graphs below, the results are broken down by country. First I show the percent of respondents in each country who choose inflation as a top-two issue. Then for a few countries, I show the percent who choose inflation and the percent who choose unemployment. In twelve countries (including Austria, France, and Germany), at least half of respondents say that inflation is a top-two issue. Sweden is a major outlier-- only 5% think that inflation is a top-two issue. The next lowest is Greece, at 26%. Sweden and Greece did have the lowest inflation in the EU in May 2012, but really just about ALL countries in the EU had (and still have) low or reasonable inflation.

Half of Germans and French thought that rising prices were a top issue, even when inflation was just 2.5%. The EC Consumer Survey, asks people how much they think prices have risen in the past 12 months. In May 2012, 28% of German, 36% of French, and 40% of Austrians thought that prices had risen "a lot."

Neil Irwin recently wrote that "The leading economies of the industrialized nations may not have a lot in common, but they are all afflicted by this: Inflation is too low." Even though inflation is too low, a lot of people think it is high-- and think that rising prices personally affect them more than unemployment. Public opinion is a powerful force, so we see policymakers being more reluctant to raise inflation when it it too low, than to lower it when it is too high.

This is rather mind boggling!

ReplyDeleteEuro area inflation officially only 1.2% — http://epp.eurostat.ec.europa.eu/cache/ITY_PUBLIC/2-16052013-AP/EN/2-16052013-AP-EN.PDF

Is this purely psychological, perhaps?

Perhaps you should also mention the response to the previous question, "What do you think are the two most important issues facing our country," to which the most common answer by far is "unemployment," followed by "economic situation," with "rising prices/inflation" a rather distant third.

ReplyDeleteThis post raises some real challenges (note the massive country differences), but I would be careful in interpreting the survey responses. First, the question asks "personally" what "issues are you facing" ... everyone goes to store and buys stuff, but not everyone loses their job in a recession. I suspect the answers might look a little different in an "in general" question.

ReplyDeleteAlso note that household's definition of inflation is not always the same as economists. They slip derivatives, for example. I have listened to tapes for a survey with inflation expectations and some of it's pretty wild. Averaging cleans up a lot. But all that aside, people do not like rising prices ... and they confront them on a daily basis. But they don't like unemployment either, so this is difficult but not impossible setup for policy.

No matter how you cut it, this is pretty bizarre. My speculation is that two confusions are rampant. First, people confuse relative price changes for changes in the price level. They see the price of gas or health care going up and they call it inflation. Second, they are subject to what I call Money Illusion Type II, seeing a general increase in the prices of the things they buy but not seeing that their own income is another such price. They are subject to the illusion that if inflation would suddenly stop they would be that much richer.

ReplyDeleteBoth confusions are widespread because they are amplified every day in the media and even endorsed by public officials, many economists and other “experts”. Economists who play this game generally know they are being disingenuous, but they think it’s in a good cause. Every time I teach macro I struggle to deconstruct this bit of error, usually to no avail. It’s too many of them against just one of me.

My hunch is that governments and central banks aim for 2% inflation because most economists think 2% is about optimum. As to the general public, they’d whine and complain about inflation even if there was none. So my guess is that politicians and central banks just ignore that whining - unless inflation gets serious, i.e. over 5% or so.

ReplyDeletePeter Dorman is right with one thing:

ReplyDeletepeople look at the visible inflation, because that is wht they can compare:

gasoline, food, daily expenses.

In May 2012 Inflation was at multi year high levels.

And those were rising a lot before May 2012: Gasoline was 10% higher than it is now, because too many refineries were closed, and apparently the north sea producers manipulated the prices ...., as we found out this week.

In many northern European countries unemployment is low, in Germany at a quarter century low.

The answers of the people do reflect their real situation

@ Ralph

ReplyDeletegenauer says:

My take on the inflation target is:

you need A target, it should be an integer, like 1.0, 2.0, 3.0, ...

You want it as high as possible, to increase the speed of adjustments in a world of sticky prices

But it has to be low enough, that people do not just automatically adjust prices/wages to it,

and for that 3.0 is too high, in fact many Euro countries still have to remove all these purpose defeating inflation adjustment clauses in pensions etc.

Mind... blown!

ReplyDeleteWow.

I think we need to correlate this survey with data on wage increases during this recession. If wage growth has been modest, then it's perhaps no surprise that people are unusually sensitive to inflation.

Note the exact wording of the question: "Personally, what are the two most important issues you are facing at the moment? "

ReplyDeleteSo there's two key words/phrases in there "Personally" and "at the moment."

If you're not sick, healthcare isn't a most important issue you are facing at the moment.

Social security, well, if you're not on it, it's not an important issue you personally are facing at this moment. If you are on social security, but are also living off savings, inflation is of course an issue. Paying for healthcare and social security is going to be a growing problem as the baby boomers retire, but it's not a top personal problem at the moment.

If you're not unemployed and no one in your house is, then unemployment isn't personally an important issue at the moment (it may be next month if you lose your job, but it isn't right now).

The financial situation of your household - that's a very general answer, compared to several specific options. Rising prices may well be more vivid. Not that unemployment rates higher than that option as well.

Society ...democratic society needs a mechanism to continuously

ReplyDeleteset

And reset

The domestic product price level

Proposals exist of course

But so long as unemployment is seen as taming product price inflation

So long as UE isn't growing significantly

so long as "the high tide of UE won't reach me/us "

is believed by a majority of citizen households

Inflation hysteria will dominate full and fast

Job market recovery

And recovery in job markets

Ie NAIRU lines and such

can be define

By policy circles not popular " wills"

Suggestion

ReplyDeleteTo host

Respond to some comments

You are not a star yet

Tracy health premiums paid by households

ReplyDeleteDeductibles ..co pays etc

These amerikana concerns

Exist in some euro systems not others

Service at health units

prolly doesn't come up as an economic problem

Etc

Lots to filter and interpret here

Host is a math major

The real world in particular foreign parts

May be for her largely an unknown complexity

Dorman makes his usual good horse sense

ReplyDeleteMusgrave a bit misty

This site deserves a set of colorful

And turbulent comment tails

Anon I

ReplyDeleteHas a fact comment

That ought to caution us

Eh?

I didn't read that comment

b 4 typing my blithering

Gets us to the problematic

Of framing phrasing and fragmenting in a nano second

Yes people can view society as a whole

thru non personal eyes

To Anonymous 1, Claudia, and Tracy:

ReplyDeleteGood points. Still, to the question "What do you think are the two most important issues facing our country," 30% of Germans say rising prices/inflation. And I think that what affects people personally does have a big political impact, maybe more so than what they think are theoretically problems but aren't affected by. Thanks for the comments at MR too, Claudia.

Peter and Anonymous 2: I think you explain a good part of it. People also probably hear about "looming" inflation in the news. Or older people have memories of high inflation and extrapolate forward, as in this paper: http://www.stanford.edu/~piazzesi/efgspring2012.pdf

ReplyDeletePaine: Suggestion taken. California time here, so I just woke up and saw the comments. You're right that I was once a math major, but I chose economics in grad school with the full intention of trying to develop my understanding of the real world (including its "foreign parts"); I know that will take many years, but I'm not just sitting here thinking that math models are everything. That's part of why I chose economic history as my second field. So I do appreciate comments that fill me in on things I am missing.

Dear Carola,

ReplyDeletejust wrote a little blogpost about your blogpost:

1. FROOPP (read the post)

2. Do not (repeat: not) underestimate the resolve of the ECB and comparable institutions to make people suffer. There is a massive power grab going on. The 'Troika' wants people to suffer from higher prices

Merijn Knibbe

Oops, forgot the link: http://rwer.wordpress.com/2013/05/20/froopp-or-understanding-peoples-perceptions-of-inflation-1-graph/

ReplyDeleteMerijn Knibbe

Merijn, thanks, I enjoyed your post. Really interesting points, especially about the new institutional arrangements and "social contract." Your graph shows that FROOP price index rose from 100 in 2005 to 124 in 2012 (while HICP rose only to 119). 124 is more than 119, but if you convert to an average annual growth rate it is still only about 3%.

ReplyDeletePaine: thanks. I'm actually a Kiwi living in London, and have spent most of my life living in countries with publicly-funded healthcare. I've only lived 3 months in the USA that I can remember.

ReplyDeleteBut just because paying for healthcare isn't a problem doesn't mean that healthcare is entirely stress-free, there's always the worry about whether you'll get better. And being in pain is painful even when your wallet is fine.

This is cool!

ReplyDeleteWe really should address the main issue of unemployment. We should also be able to dig deep on it's cause to know where the real problem came from.

ReplyDeleteHaving an income protection cover is a good preparation for economic problems.

ReplyDeleteYour savings or money is very important to each and every individuals because they work hard for it. Investing for insurance income protection is one that makes you feel comfortable that even if in unexpected situation your money is secured.

ReplyDeletetrendmicro.com/activation - Follow steps to download, install, and activate Trend Micro product. Type the product key by clickingtrendmicro.com/activation.

ReplyDeleteAvast Activate- Get free or paid Avast antivirus. Download, install, and activate it from avast.com/activate

norton.com/setup - Get steps to download norton, install, reinstall norton setup here. Activate Norton setup with key code at www.norton.com/setup.

ReplyDeleteVisit: norton.com/setup | norton.com/setup