|

| Figure 1. Source: http://www.census.gov/construction/nrs/ |

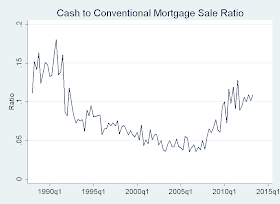

Here's an economic data series to watch in 2014. The mean home price for homes paid for in cash shot above the mean home price for homes financed by conventional mortgages in the second and third quarters of 2013. (Later data is not yet available, and the 2013Q3 data is still preliminary.) The mean price for a cash purchase was $408,200, compared to $338,900 for a conventional mortgage. These figures refer to new one-family homes. The ratio of number of new homes purchased with cash to number of new homes financed by a conventional mortgage is just above 10%, more than double its value in the mid-2000s, but still below the early 1990s (Figure 2, below).

In the 1990s and most of the early 2000s, homes financed with conventional mortgages consistently sold for a higher mean price than homes finances with cash--around $20,000 higher. Now, homes financed with a conventional mortgage are about $69,000 less than cash-financed homes.

In real terms, the mean price of a home purchased with cash is nearly as high as its record in the third quarter of 2007. Right in the thick of the housing crisis, cash purchase prices spiked above conventional mortgage prices in 2007Q2 and Q3. Towards the end of the 2007Q3, the Federal Reserve made its first rate cut in four years, and the cash purchase price fell sharply in 2007Q4.

The spike in the mean home price for cash financing in the most recent two quarters was of similar magnitude to the spike in 2007Q2-3. I will be watching the next few releases of this data with interest, as I think it provides some indication of the uneven nature of the housing recovery, and will be informative about the impacts of tapering. The housing market is rather segmented, and Fed policy has differential impacts on cash-in-hand investors and "typical" households. According to the Wall Street Journal,

"The pool of potential buyers is being limited thanks to a combination of tight lending standards and rising interest rates, experts say. `Cash is king in hot markets where getting the sale done now matters and where investors are driving price recovery,' says Susan M. Wachter, professor of real estate and finance at The Wharton School at the University of Pennsylvania. Cash’s dominance is a sign of the fact that it’s more costly and hard to get financing, she says, 'that’s a bad thing.'"Cleveland Fed President Sandra Pianalto remarked in November 2013 that "Over the past year,...housing has been a relative star performer in the economy. Prices, starts, and sales are up. But despite this progress, the housing sector still has a way to go to regain the vitality it enjoyed prior to the recession." She added:

Looking ahead, tight conditions in mortgage credit markets will continue to hold the housing sector and broader economy from getting back to full strength more quickly... In a recent Federal Reserve survey of senior loan officers, bankers reported that credit standards for all categories of home mortgage loans have remained tighter than the standards that have prevailed on average since 2005...Financial market regulators are standing vigilant to ensure there is no recurrence of the housing bubble that almost brought the financial system and global economy to its knees.

Moreover, access to mortgage credit has become far more restrictive. To get a mortgage today, it helps to have a very high credit score. Lenders are more likely to extend mortgage credit to consumers they perceive as very low risk. As a result, the pool of potential mortgage borrowers has shrunk. Households with low credit scores that were able to get credit before the crisis now are the least able to refinance their homes, or to obtain new mortgage loans.

|

| Figure 2. Source: http://www.census.gov/construction/nrs/ |

I have to say the citation from the Wall Street Journal gives me a psychic itch. The housing bubble whose aftermath is still affecting the economy was caused, at least in part, by the idea that some few markets were "hot".

ReplyDeleteIt also seems likely the time series you're tracking here is ultimately caused by QE and the consequent interest-rate repression.

I do agree with you Fitz, however I think before getting or approved to access mortage we need to have a high credit score. It has an impact for people like me that do not use credit card too often. Anyway, I am looking at this development located at Singapore http://www.amorecondo.com/ and I do hope by the time I decided to get one I'll be able to get an international mortgage loan.

ReplyDelete