1. Rajan Signals India Inflation Target Amid Vote Tension (Bloomberg): India central bank Governor Raghuram Rajan may attempt to make inflation the bank's primary priority. Rajan says, "If the government policies in aggregate prove to be

expansionary, we will have to adjust policies ourselves to meet

the overall disinflationary process. We can’t throw up our hands in some

sense and say there is nothing we can do because of the fiscal

dominance."

2. Hungary Rate-Cut Resolve Challenged by Investors as Forint Drops (Bloomberg): Inflation in Hungary is at its lowest since 1970. Central banks in Turkey and South Africa are raising rates to try and stop falling currencies, but the Hungarian central bank faces a challenge because monetary easing is more appropriate to its inflation and growth conditions.

3. Inflation in Euro Zone Falls, and a 12% Jobless Rate Doesn’t Budge (NYT): The 0.7 percent inflation rate may have surprised the ECB.

4. Japan’s Inflation Accelerates as Abe Seeks Wage Gains (Bloomberg): Japan's inflation has inched up, but the real test will come at the annual wage talks in April. Prime Minister Shinzo Abe has met five times since September with business and

union leaders to encourage them to raise salaries, which have risen slower than prices.

Pages

▼

Friday, January 31, 2014

Friday, January 24, 2014

Inflation Stories of the Week (January 24, 2014)

1. Should We Worry about Deflation? (The Economist): Professor Paul DeGrauwe says that the Euro zone already suffers from debt-deflation dynamics: "Inflation in the euro zone has been declining since early

last year and now stands at 0.8%. This disinflation exerts

debt-deflation dynamics, which are of the same nature as those analysed

by Irving Fisher...

It is not yet catastrophically intense, but surely it should be stopped

before it gets worse when inflation turns negative."

2. Plunging Rand, Soaring Maize Price to Stoke South African Inflation (Reuters): A weakening rand and record-high maize prices resulting from rain shortfall are causing concerns about upside inflation risks in South Africa. The central bank may raise rates in the next few months.

3. Narcos-Versus-Farmers Feud Spurs Inflation Wagers (Bloomberg): In Mexico, conflict between vigilante farmers and drug gangs in Michoacan state’s lime-growing valleys is expected to increase agricultural prices and inflation.

4. Soaring Rural Wages Created Low-Growth, High Inflation: Morgan Stanley (Economic Times)

5. Bank of Japan Sticks to Record Easing as Inflation Picks Up (Bloomberg): The recent BOJ statement says the rate of increase in core consumer prices is expected to be around 1.25% "for some time." Interestingly, unlike the previous statement, this one did not include the comment that “there remains a high degree of uncertainty concerning Japan’s economy.” Sales taxes will increase from 5% to 8% in April. Base wages excluding bonuses and overtime fell for the 18th straight month.

2. Plunging Rand, Soaring Maize Price to Stoke South African Inflation (Reuters): A weakening rand and record-high maize prices resulting from rain shortfall are causing concerns about upside inflation risks in South Africa. The central bank may raise rates in the next few months.

3. Narcos-Versus-Farmers Feud Spurs Inflation Wagers (Bloomberg): In Mexico, conflict between vigilante farmers and drug gangs in Michoacan state’s lime-growing valleys is expected to increase agricultural prices and inflation.

4. Soaring Rural Wages Created Low-Growth, High Inflation: Morgan Stanley (Economic Times)

"We

believe the National Rural Employment Guarantee Act (NREGA) Scheme has

been one of the key factors pushing rural wages without matching gains

in productivity...

: A note by Morgan Stanley India blames the National Rural Employment Guarantee Act for pushing up rural wages in India without a corresponding rise in productivity. The note says that rural wages grew an average of 18.7% per year over the past 3 years, contributing to a stagflationary environment.5. Bank of Japan Sticks to Record Easing as Inflation Picks Up (Bloomberg): The recent BOJ statement says the rate of increase in core consumer prices is expected to be around 1.25% "for some time." Interestingly, unlike the previous statement, this one did not include the comment that “there remains a high degree of uncertainty concerning Japan’s economy.” Sales taxes will increase from 5% to 8% in April. Base wages excluding bonuses and overtime fell for the 18th straight month.

6. The Mystery of China's Fading Inflation, Explained (Quartz): Here's a theory about China's slowing CPI inflation rate: "What

makes China unlike Western economies is that the government, not the

market, determines the interest rates—in other words, the cost of

money—on both deposits and loans. By setting them both artificially low, the government shifts wealth from savers to borrowers...As

for China’s hapless savers, the closed capital account leaves them

unable to invest in much else, so despite lousy rates, they keep

stashing their cash in banks. This unfair distribution is why the money supply can surge without juicing consumer inflation."

Soaring rural wages created low-growth, high-inflation: Morgan Stanley

Soaring rural wages created low-growth, high-inflation: Morgan Stanley

Wednesday, January 22, 2014

Lance Davis (1928-2014)

Lance Edwin Davis passed away this week. A renowned economic historian with major contributions in financial history and institutional economics, Davis was a professor at Caltech from 1968 to 2005.

Davis is associated with cliometrics, a quantitative and systematic approach to analyzing economic history. The term cliometrics--combining Clio, the muse of history, with metrics from econometrics--was coined in the 1950s by a group of economic historians and mathematical economists at Purdue University. Davis was a key member of this group, along with Jonathan Hughes and Stanley Reiter. This group obtained funds from Purdue to start a new conference series, originally called the Conference on the Application of Economic Theory and Quantitative Methods to the Study of Problems of Economic History, and later called the Cliometric Conference, or just Clio.

The Cliometrics Conferences helped bring about a renewal in the economic history field. The new generation of economic historians in the 1950s and 60s began integrating economic theory and empirical evidence more rigorously and creatively than before. Often, this involved extensive efforts to uncover and tabulate historical data. Davis and Louis Stettler's "The New England Textile Industry, 1825-60: Trends and Fluctuations" (1966) is an example of this type of work.

Davis' efforts to integrate theory and empirical evidence are particularly valuable in the area of financial history. In "The Investment Market, 1870-1914: The Evolution of a National Market" (1965), Davis notes that the classical assumption of perfect capital mobility implies that rates of return on capital should be equal across regions and industries. Interest rate differentials provide information about the barriers to capital mobility. Davis' paper gathers data on interest rate differentials among six regions of the United States from 1870-1914 and analyzes the institutional innovations that reduced barriers to capital mobility over that period.

The cliometric approach also brought about a new way of thinking about economic institutions and institutional change. Neoclassical institutional theory flourished in the 1960s, led by Davis and Douglass North, who developed a model of the logic and incentives that shape the institutional environment. Davis and North's hugely influential book, Institutional Change and American Economic Growth (1971), outlines their model and applies it to American economic history.

In other work, Davis focuses on British financial markets and British imperialism. He and Robert Huttenback wrote the book Mammon and the Pursuit of Empire: The Political Economy of British Imperialism, 1860-1912 (1986). They examine the economics of imperialism, including the returns on investment in empire-building and the social costs of maintaining the empire. The analysis portrays British imperialism as a mechanism to that transferred income from the tax-paying middle class to the elites.

Among Davis' other works are In Pursuit of Leviathan: Technology, Institutions, Productivity, and Profits in American Whaling, 1816-1906 (1997) with Robert Gallman and Karin Gleiter, and Evolving Financial Markets and International Capital Flows: Britain, the Americas, and Australia, 1870–1914 (2001) with Robert Gallman.

An interview with Davis in 1998 is full of interesting stories about his life and work, including his naval service in WWII and the Korean War. The interview tells of his role shaping the Caltech social sciences division. He was there when Caltech admitted its first social sciences PhD student, Barry Weingast, in 1974. There is a strong sense of community among economic historians in California, of which Davis was a central part.

Davis is associated with cliometrics, a quantitative and systematic approach to analyzing economic history. The term cliometrics--combining Clio, the muse of history, with metrics from econometrics--was coined in the 1950s by a group of economic historians and mathematical economists at Purdue University. Davis was a key member of this group, along with Jonathan Hughes and Stanley Reiter. This group obtained funds from Purdue to start a new conference series, originally called the Conference on the Application of Economic Theory and Quantitative Methods to the Study of Problems of Economic History, and later called the Cliometric Conference, or just Clio.

The Cliometrics Conferences helped bring about a renewal in the economic history field. The new generation of economic historians in the 1950s and 60s began integrating economic theory and empirical evidence more rigorously and creatively than before. Often, this involved extensive efforts to uncover and tabulate historical data. Davis and Louis Stettler's "The New England Textile Industry, 1825-60: Trends and Fluctuations" (1966) is an example of this type of work.

Davis' efforts to integrate theory and empirical evidence are particularly valuable in the area of financial history. In "The Investment Market, 1870-1914: The Evolution of a National Market" (1965), Davis notes that the classical assumption of perfect capital mobility implies that rates of return on capital should be equal across regions and industries. Interest rate differentials provide information about the barriers to capital mobility. Davis' paper gathers data on interest rate differentials among six regions of the United States from 1870-1914 and analyzes the institutional innovations that reduced barriers to capital mobility over that period.

The cliometric approach also brought about a new way of thinking about economic institutions and institutional change. Neoclassical institutional theory flourished in the 1960s, led by Davis and Douglass North, who developed a model of the logic and incentives that shape the institutional environment. Davis and North's hugely influential book, Institutional Change and American Economic Growth (1971), outlines their model and applies it to American economic history.

In other work, Davis focuses on British financial markets and British imperialism. He and Robert Huttenback wrote the book Mammon and the Pursuit of Empire: The Political Economy of British Imperialism, 1860-1912 (1986). They examine the economics of imperialism, including the returns on investment in empire-building and the social costs of maintaining the empire. The analysis portrays British imperialism as a mechanism to that transferred income from the tax-paying middle class to the elites.

Among Davis' other works are In Pursuit of Leviathan: Technology, Institutions, Productivity, and Profits in American Whaling, 1816-1906 (1997) with Robert Gallman and Karin Gleiter, and Evolving Financial Markets and International Capital Flows: Britain, the Americas, and Australia, 1870–1914 (2001) with Robert Gallman.

An interview with Davis in 1998 is full of interesting stories about his life and work, including his naval service in WWII and the Korean War. The interview tells of his role shaping the Caltech social sciences division. He was there when Caltech admitted its first social sciences PhD student, Barry Weingast, in 1974. There is a strong sense of community among economic historians in California, of which Davis was a central part.

Friday, January 17, 2014

Inflation Stories of the Week (January 17, 2014)

I'm adding something new to the blog. Every Friday, I'll post a round-up of the week's most interesting news and research about inflation around the world. Send me story tips during the week on twitter or by email. Or add stories I've missed in the comments.

1. McDonald’s Agrees to Cut the Price of a Venezuelan Big Mac Combo (Bloomberg): McDonald's lowered the price of a Big Mac combo by 7.5% at its 139 restaurants in Venezuela. The decision was made a week after the government came to inspect company offices. In Venezuela, where inflation is the highest in the world, military-backed price regulators have forced 1000 businesses to lower prices. The Big Mac price cut is noteworthy because of the "Big Mac Index," a lighthearted but widely referenced gauge of currency misalignment.

2. Sri Lanka to Change Inflation Index to Cover Whole Nation (Daily Mirror): In May, the IMF said that Sri Lanka’s national accounts “suffer from insufficient data sources and undeveloped statistical techniques.” The current index only represents the capital city, Colombo. The new index will cover the whole nation. Sri Lanka recently cut a policy rate by 50 bpt, against the advice of the IMF.

3. Brazil Signals Inflation Will Extend World’s Biggest Rate Rise (Bloomberg): Concerns about inflation led to the sixth straight 50 bpt increase in Brazil's benchmark policy rate.

4. Make Inflation-Indexed Bonds More Attractive (New Indian Express): India is trying to issue inflation-indexed bonds, in part to wean investors away from gold and real estate. But investor response was tepid and the bonds are undersubscribed, so the government has extended the subscription deadline by 3 months.

5. Government Studies Ways to Modernize Inflation-Data Collection (WSJ): In the United States, a new BLS project is attempting to get price data directly and electronically from businesses for use in the Consumer Price Index.

1. McDonald’s Agrees to Cut the Price of a Venezuelan Big Mac Combo (Bloomberg): McDonald's lowered the price of a Big Mac combo by 7.5% at its 139 restaurants in Venezuela. The decision was made a week after the government came to inspect company offices. In Venezuela, where inflation is the highest in the world, military-backed price regulators have forced 1000 businesses to lower prices. The Big Mac price cut is noteworthy because of the "Big Mac Index," a lighthearted but widely referenced gauge of currency misalignment.

2. Sri Lanka to Change Inflation Index to Cover Whole Nation (Daily Mirror): In May, the IMF said that Sri Lanka’s national accounts “suffer from insufficient data sources and undeveloped statistical techniques.” The current index only represents the capital city, Colombo. The new index will cover the whole nation. Sri Lanka recently cut a policy rate by 50 bpt, against the advice of the IMF.

3. Brazil Signals Inflation Will Extend World’s Biggest Rate Rise (Bloomberg): Concerns about inflation led to the sixth straight 50 bpt increase in Brazil's benchmark policy rate.

4. Make Inflation-Indexed Bonds More Attractive (New Indian Express): India is trying to issue inflation-indexed bonds, in part to wean investors away from gold and real estate. But investor response was tepid and the bonds are undersubscribed, so the government has extended the subscription deadline by 3 months.

5. Government Studies Ways to Modernize Inflation-Data Collection (WSJ): In the United States, a new BLS project is attempting to get price data directly and electronically from businesses for use in the Consumer Price Index.

Wednesday, January 15, 2014

On Euler Equations

Noah Smith calls the Euler Equation "The Equation at the Core of Macro." He explains, "For the uninitiated, the Consumption Euler (pronounced "oiler") Equation is sort of like the Flux Capacitor that powers all modern 'DSGE' macro models." He adds:

DSGE stands for dynamic stochastic general equilibrium. It is really the D of DSGE that brings in the Euler equations. Optimization problems--which are what a lot of economists and even non-economists solve-- whether deterministic or stochastic, whether partial or general equilibrium, have first-order conditions. Dynamic optimization problems have more than one time period, so you can have first-order conditions in consumption in different time periods. Combine these first-order conditions in consumption with a budget constraint and you get an Euler equation--whether or not you are writing down a DSGE model. The most obvious ways to get rid of the Euler equation are to get rid of optimization (a la Campbell and Mankiw 1991), add other constraints (liquidity constraints, incomplete markets), or pick weird preference relations that make utility non-time-separable (a la Campbell Cochrane 1999).

Euler equations are also foundational in finance and asset pricing. John Cochrane's "Asset Pricing" textbook, used in most graduate-level asset pricing courses, begins with a chapter based on the Euler equation. Here is a chapter by Campbell on Consumption-Based Asset Pricing which makes clear that the Euler equation is at the heart.

A 2012 paper by Sydney Ludvigson, called "Advances in Consumption-Based Asset Pricing:

Empirical Tests," provides a good overview of the empirical literature on consumption-based asset pricing. Ludvigson explains that "early empirical studies found that the model was both formally and informally rejected in a variety of empirical settings." However, "In response to these findings, researchers have altered the standard consumption-based model to account for new preference orderings based on habits or recursive utility, or new restrictions on the dynamics of cash-flow fundamentals, or new market structures based on heterogeneity, incomplete markets, or limited stock market participation." Ludvigson's paper might address some of the issues that commenters to Noah's post brought up.

"This equation underlies every DSGE model you'll ever see, and drives much of modern macro's idea of how the economy works. So why is Eichenbaum, one of the deans of modern macro, pooh-poohing it?Noah points to a 2006 paper that uses US data to calculate the interest rate implied by the Euler equation under various assumptions about preferences. The authors compare this Euler equation rate with a money market rate, and find that the two series differ significantly. Noah writes:

Simple: Because it doesn't fit the data. The thing is, we can measure people's consumption, and we can measure interest rates. If we make an assumption about people's preferences, we can just go see if the Euler Equation is right or not!"

"If this paper is right - and one paper is not enough to be conclusive - then essentially all modern DSGE-type macro models currently in use are suspect. The consumption Euler Equation is an important part of nearly any such model, and if it's just wrong, it's hard to see how those models will work... We need a whole literature of papers analyzing whether the Euler Equation is usable or not."I just want to make the point that Euler equations are not only part of "modern DSGE-type macro models," and that we do have a pretty big empirical literature on the Euler equation. Here are lecture notes from a microeconomics course deriving the Euler equation.

DSGE stands for dynamic stochastic general equilibrium. It is really the D of DSGE that brings in the Euler equations. Optimization problems--which are what a lot of economists and even non-economists solve-- whether deterministic or stochastic, whether partial or general equilibrium, have first-order conditions. Dynamic optimization problems have more than one time period, so you can have first-order conditions in consumption in different time periods. Combine these first-order conditions in consumption with a budget constraint and you get an Euler equation--whether or not you are writing down a DSGE model. The most obvious ways to get rid of the Euler equation are to get rid of optimization (a la Campbell and Mankiw 1991), add other constraints (liquidity constraints, incomplete markets), or pick weird preference relations that make utility non-time-separable (a la Campbell Cochrane 1999).

Euler equations are also foundational in finance and asset pricing. John Cochrane's "Asset Pricing" textbook, used in most graduate-level asset pricing courses, begins with a chapter based on the Euler equation. Here is a chapter by Campbell on Consumption-Based Asset Pricing which makes clear that the Euler equation is at the heart.

A 2012 paper by Sydney Ludvigson, called "Advances in Consumption-Based Asset Pricing:

Empirical Tests," provides a good overview of the empirical literature on consumption-based asset pricing. Ludvigson explains that "early empirical studies found that the model was both formally and informally rejected in a variety of empirical settings." However, "In response to these findings, researchers have altered the standard consumption-based model to account for new preference orderings based on habits or recursive utility, or new restrictions on the dynamics of cash-flow fundamentals, or new market structures based on heterogeneity, incomplete markets, or limited stock market participation." Ludvigson's paper might address some of the issues that commenters to Noah's post brought up.

Sunday, January 5, 2014

Emporiophobia!

The game, it turns out, is quite fun, and I've already been subjecting house guests to it (so be forewarned.) Forbidden Island came instantly to mind when I just came across a new article by Paul Rubin, an economics professor at Emory University. I was attracted to the article by the title, which introduces a fun new word: "Emporiophobia (Fear of Markets): Cooperation or Competition?" (Southern Economic Journal, forthcoming.) Though I find plenty to disagree with in the article, it is very thought-provoking and an enjoyable read. From the abstract:

Emporiophobia is a made-up word, and my first instinct was to wonder if it described a made-up problem. Actual fear of markets isn't something I see much-- even in Berkeley, subsistence farming hasn't gotten trendy. But Rubin says fear of markets is "all around us." He directs readers to Bryan Caplan's book, The Myth of the Rational Voter, for evidence of rampant emporiophobia. He also cites a recent article, "Economic Experts versus Average Americans" by Paola Sapienza and Luigi Zingales, and articles on anti-market bias in movies. When he begins to describe examples of emporiophobia, I realize that the term means something different than I thought:Widespread emporiophobia (fear of markets) has important policy implications, as it leads voters to demand anti-market policies. There are many reasons for this anti-market attitude; however, economists could reduce emporiophobia if we stressed cooperation rather than competition in writings and policy discussions. In a sample of introductory textbooks, competition is mentioned on average eight times as often as cooperation. The fundamental economic unit is the transaction, and transactions are cooperative. The benefit of a market economy - increased consumer surplus - comes from cooperation through transactions, not from competition. Competition in a market economy is competition for the right to cooperate. Competition is important because it guarantees that the best cooperators will win and because it establishes the efficient terms for cooperation, but cooperation is fundamental. For most people, competition has negative connotations as it focuses on losers, while cooperation implies a win-win situation.

"The statute books are full of laws limiting or restricting markets (minimum wages, farm price supports, occupational licensing laws, tariffs, numerous entry restrictions, anti-gouging regulations following disasters). Washington is packed with regulatory agencies whose purpose is to limit the functioning of markets. (I myself worked for two such agencies, the Federal Trade Commission, in the 'consumer protection' area, and the Consumer Product Safety Commission.)"In other words, he classifies any desire to limit or regulate markets as fear of markets-- a fear that Rubin himself overcame. Rubin describes his own conversion from a young person who was "quite leftist, and even socialist, as was consistent with my demographic" to a "hard core believer in markets."

While I do not agree that minimum wages, consumer protection, and the like exemplify a fear that needs to be alleviated, I do find discussions of the language and metaphors of economics very interesting. Rubin cites Deirdre McCloskey's classic work on rhetoric and metaphors in economics, and contributes his own analysis of the language in popular economics textbooks. He looks at the relative frequencies of the words "competition" and "cooperation" in a number of microeconomics texts.

Tyler Cowen and Alex Tabarrok's Modern principles: Microeconomics mentions competition 8 times as often as cooperation, which is about average. The highest ratio, 20.43, is Robert Frank and Ben Bernanke's Principles of Microeconomics. Greg Mankiw's Principles of Microeconomics and Paul Krugman and Robin Wells' Microeconomics have the lowest ratios, at 5.45 and 4.45, respectively. I don't find these ratios terribly surprising, since these are micro texts so they likely include multiple chapters on market structure: the differences between perfect competition, monopolistic competition, and monopoly. It would be interesting to look at macro texts. In my blog, which is more or less macro-focused, I can't recall using either term very frequently.

Why does Rubin care so much about the terms competition and cooperation? He explains, in a thoughful passage:

People engage in economic activities in order to maximize utility, and winning or losing (for example, having the largest market share, or the largest profit, or the highest income) is incidental to the actual goal, although some may gain utility from having the largest market share. Then characterizing behavior as competitive is metaphoric, and is not in general the best metaphor. “Competition” is a metaphor borrowed from sports, and it is not an appropriate metaphor for the economy.He also adds a smart discussion of the zero-sum thinking that can accompany the idea of competition. Zero-sum thinking, when applied inappropriately, is indeed a harmful misconception. Some of his applications, however, I find problematic. "It is natural for people to observe those who are unsuccessful (e.g., the poor, the homeless, failed businesses) and assume that these people are the losers from economic competition, and that their unfortunate position was caused by competition," he writes. He adds,

The most fundamental economic act is the transaction...Moreover, as economists we know that all parties expect to benefit from a transaction, else it would not occur. Thus, a transaction is a cooperative act–an act benefitting all who voluntarily participate in it. The essence of economics is cooperation through transactions and markets.

"Why are some people poor? The competitive metaphor says they are poor because they were outcompeted, and perhaps their wealth was expropriated by the rich. (The folk saying “The rich get richer and the poor get poorer” implies causality.) But economists know that this is not why people are poor. They are poor because they have little or nothing worthwhile to sell–no capital, no valuable marketable skills. That is, the poor are poor because they are unable to enter into cooperative relationships with others. We may feel sorry for someone who is poor, whether this is because they have lost in a competitive contest or because they are unwilling or unable to cooperate successfully with others...There is no external agent to blame for poverty if the poverty is caused by a lack of things to sell, rather than by losing in a competitive contest. The solution to poverty caused by a lack of something to sell is to increase the human capital of the poor, generally through increased education.

This is an important point. Much harm is done by seeking villains who have caused poverty, generally by being viewed as outcompeting others. For one example, consider that the poor may not have much to sell, but they may have something. But if we view poverty as being caused by successful competitors exploiting the poor in markets, we may restrict the markets in which the poor do cooperate (for example, through usury laws or minimum wages) and actually reinforce their poverty."First, increasing the human capital and education of the poor is certainly a noble goal, but is an unrestricted market likely to attain it in the near future? I find that unlikely. Second, exploitation and expropriation can and do exist, even in a free market. Even if we describe markets as cooperative, there is no guarantee of fair play. Third, even if we describe markets as cooperative, unreasonable levels of inequality still result. "Lack of things to sell" or inability to cooperate are unsatisfactory explanations of poverty, and I see no explanation of how an unrestricted market would address them. I can't say that I have a fool-proof solution to poverty, but I do think that seeking and implementing better policy solutions is necessary. In that sense, a healthy fear of markets is a good thing.

One final note. If I think back to my own introductory economics education, the "c" word that stood out most to me was neither competition nor cooperation, but coordination. After all, the invisible hand is one of the profession's most famous metaphors.

Friday, January 3, 2014

Tale of Two Housing Markets

|

| Figure 1. Source: http://www.census.gov/construction/nrs/ |

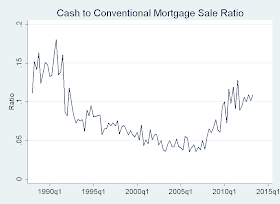

Here's an economic data series to watch in 2014. The mean home price for homes paid for in cash shot above the mean home price for homes financed by conventional mortgages in the second and third quarters of 2013. (Later data is not yet available, and the 2013Q3 data is still preliminary.) The mean price for a cash purchase was $408,200, compared to $338,900 for a conventional mortgage. These figures refer to new one-family homes. The ratio of number of new homes purchased with cash to number of new homes financed by a conventional mortgage is just above 10%, more than double its value in the mid-2000s, but still below the early 1990s (Figure 2, below).

In the 1990s and most of the early 2000s, homes financed with conventional mortgages consistently sold for a higher mean price than homes finances with cash--around $20,000 higher. Now, homes financed with a conventional mortgage are about $69,000 less than cash-financed homes.

In real terms, the mean price of a home purchased with cash is nearly as high as its record in the third quarter of 2007. Right in the thick of the housing crisis, cash purchase prices spiked above conventional mortgage prices in 2007Q2 and Q3. Towards the end of the 2007Q3, the Federal Reserve made its first rate cut in four years, and the cash purchase price fell sharply in 2007Q4.

The spike in the mean home price for cash financing in the most recent two quarters was of similar magnitude to the spike in 2007Q2-3. I will be watching the next few releases of this data with interest, as I think it provides some indication of the uneven nature of the housing recovery, and will be informative about the impacts of tapering. The housing market is rather segmented, and Fed policy has differential impacts on cash-in-hand investors and "typical" households. According to the Wall Street Journal,

"The pool of potential buyers is being limited thanks to a combination of tight lending standards and rising interest rates, experts say. `Cash is king in hot markets where getting the sale done now matters and where investors are driving price recovery,' says Susan M. Wachter, professor of real estate and finance at The Wharton School at the University of Pennsylvania. Cash’s dominance is a sign of the fact that it’s more costly and hard to get financing, she says, 'that’s a bad thing.'"Cleveland Fed President Sandra Pianalto remarked in November 2013 that "Over the past year,...housing has been a relative star performer in the economy. Prices, starts, and sales are up. But despite this progress, the housing sector still has a way to go to regain the vitality it enjoyed prior to the recession." She added:

Looking ahead, tight conditions in mortgage credit markets will continue to hold the housing sector and broader economy from getting back to full strength more quickly... In a recent Federal Reserve survey of senior loan officers, bankers reported that credit standards for all categories of home mortgage loans have remained tighter than the standards that have prevailed on average since 2005...Financial market regulators are standing vigilant to ensure there is no recurrence of the housing bubble that almost brought the financial system and global economy to its knees.

Moreover, access to mortgage credit has become far more restrictive. To get a mortgage today, it helps to have a very high credit score. Lenders are more likely to extend mortgage credit to consumers they perceive as very low risk. As a result, the pool of potential mortgage borrowers has shrunk. Households with low credit scores that were able to get credit before the crisis now are the least able to refinance their homes, or to obtain new mortgage loans.

|

| Figure 2. Source: http://www.census.gov/construction/nrs/ |